Winning the Asset Management Performance Challenge

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

[An active equity investment strategy can deliver superior returns but outperforming their benchmarks on a consistent basis is not easy as proven by the year-end 2023 SPIVA scorecard on mutual funds. Due to the growing complexity of the markets, key components of the underperformance issue may be found in a need for better information and research tools on validating underlying stock and market trends and the need for ongoing testing of the manager’s fundamental hypotheses and assumptions. Conventional investment research, data, and tools seem to be inadequate at delivering alpha.

To better understand this performance challenge and explore potential investment performance solutions, we reached out to Institute Founding member Rocco Pellegrinelli, CEO of Trendrating – a Swiss-based company providing advanced alpha discovery and price trend analytic research solutions. Acting as a performance management partner for investment managers, he specifically designed his Trendrating research platform with modern technology and market intelligence capabilities that, in a few clicks, can be quickly added as an overlay to an investment manager’s current investment processes to help them beat benchmarks and passive fund performance on an ongoing basis.]

Hortz: Why do you think many active managers underperform their benchmarks per the annual SPIVA report? What do you feel is at the heart of this underperformance situation?

Pellegrinelli: Over many years, active management shops have built investment systems and processes that accessed conventional data, mainstream research, and prevailing investment tools being used that unfortunately cannot provide the necessary market intelligence currently needed. The SPIVA report leads us to the realization that stock price action is impacted by stronger forces that have emerged making the markets more complex for managers. These developments have steadily weakened the previous correlations with old-school fundamentals and traditional price trend methodologies.

Frankly, I feel the main problem is the tendency to work on assumptions and ideas that are not properly tested and validated on an ongoing basis with robust statistical evidence. Fact-finding and discovering what is the real alpha contribution of the selection criteria and parameters used provides a wise, mandatory, sanity check.

Managers need and deserve more modern research tools. By adding another layer of market intelligence and a dynamic market perspective, advanced analytics can enhance ANY investment process in ANY investment style and offer the potential for generating more alpha and risk management protections.

Hortz: Why do you feel that investment managers need to address these performance concerns right now?

Pellegrinelli: We feel strongly that modern research tools are always relevant and need to be explored, but managers right now especially need to prepare for an investment environment far different than the relatively easier one of the last decade. Some of the outlier reports and news we increasingly are seeing that caught our eye include:

Goldman Sachs recently forecasted that the S&P 500 index will deliver a nominal annualized return of just 3% over the next decade (not adjusted for inflation), significantly lower than the 13% annualized return seen in the past 10 years. This could mean six months up 10% and six months down 7% with more frequent bear phases in between. In this kind of changing market regime, I would say good-bye to index funds and passive strategies.

Norway’s Norges Bank Investment Management (NBIM), one of the largest sovereign funds in the world (approx. $1.8 trillion), also recently informed their stakeholders that they will reduce their equity exposure. What can be the impact of this news on other sovereign funds, corporate retirement plans, and institutional asset allocators? What if they and others decide to exit even only 5% of their holdings, obviously across many, many months as NBIM reaffirmed that it stands by its position of not making large asset allocation shifts on a short-term basis.

It is time not to be complacent or dismiss these shifting investment market scenarios and the importance of exploring modern research tools designed to gain new evolving insights and control risks. It should be a “must have” to any investor with a minimum sense of perspective. Who can rule out another 2022? What did we learn then? Are you equipped this time?

Hortz: What steps do you suggest that managers take in attempting to solve this performance challenge?

Pellegrinelli: The key focus needs to be on better information to support better decisions and better performance. We built access to a wealth of facts and knowledge designed for easy and quick research discovery of best alpha generating fundamental and price trend factors not available in other platforms.

Our research platform, based on hard fact-finding and rigorous testing over history, provides the answers to essential questions that have been impacting performance. Here are the steps we offer on solving the manager performance challenge:

Step One – Profit from modern market intelligence through advanced technology, strategic research tools, and collecting new valuable knowledge. Explore, test, optimize, and gain insights based on rigorous fact-finding to see if your investment assumptions or strategies stand up to scrutiny and are adequately addressing current market dynamics.

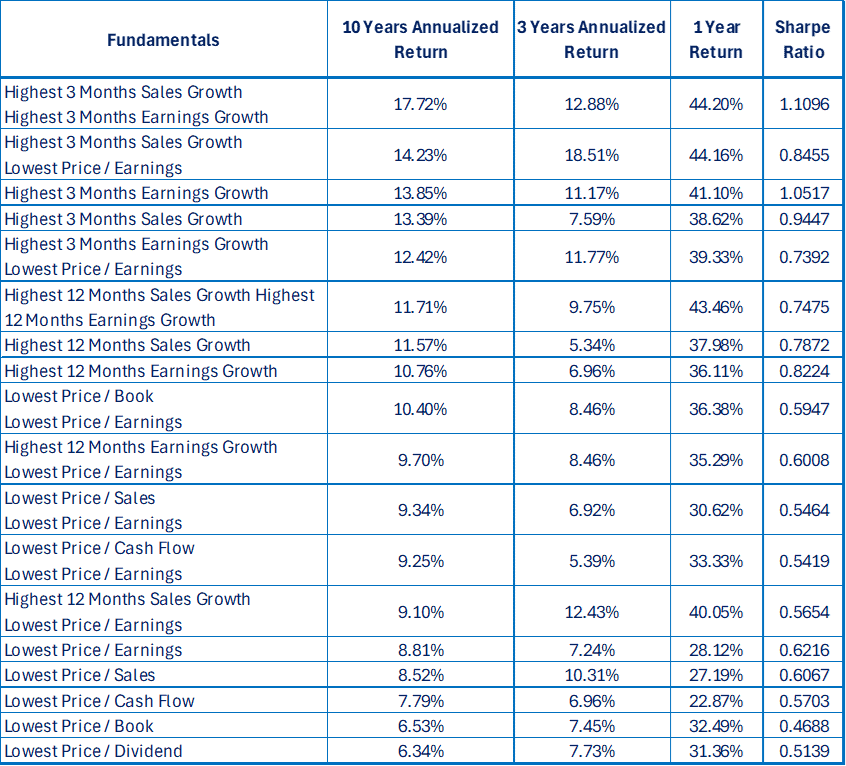

Step Two – Analyze the true alpha produced by different fundamental parameters to unveil which fundamental factors or combination of factors delivers the best results. This may differ across sectors. Discover what works and what does not in different investment universes. Checking the right boxes can make the difference.

Step Three – Use a pragmatic trend validation research tool to add a layer of “ trend risk “ control. This can help avoiding the damage of owning stocks in a bear trend and quickly capturing stocks or sectors entering a bull trend. It also can help fine tune stock entry and exit point decisions.

Hortz: How did you design your investment technology to help investment managers with these recommended steps? What is behind your rating methodologies?

Pellegrinelli: For years as a portfolio manager, I grew very frustrated with the fact that the data and the tools I used did not help my performance. Our mission is to change the game and offer the possibility to discover what works and what does not, and the ability to build superior active strategies by combining the most productive parameters. More specifically, our research shows that the most effective approach is selecting only the stocks that show the fundamentals that perform best and with a validated positive price trend.

Our research platform was designed using AI and advanced analytics enabling a better informed and more effective performance management process with new market intelligence that investment managers need.

The price trend model is based on a “pattern recognition” algorithm that processes a large volume of data assessing the actual buying vs. selling pressure of stocks and sectors in the mid-long term. The algorithm works on a multi-factor analysis and uses a self-adaptive, flexible time window. When the different factors are in synch, there is a high probability that a relevant trend is in place. The dynamic time window enables a timelier identification of an emerging trend and the multi-factor approach supports an effective filtering of price noise, short term volatility, and false moves.

Our strategy builder research solution was developed on a directory of fundamental parameters where you can find the best contributors to performance based on an AI clustering algorithm – a leading-edge technology that, in a few clicks, makes possible to explore, test, optimize, and validate different combinations of fundamental parameters. It is a unique platform and system that can be used to combine the most productive fundamental parameters and a trend quality filter. A game changer.

Managers can find the facts that drive prices – gain new insights, combine the most productive fundamental selection parameters, exploit the performance dispersion across stocks, and maximize their investment performance. The research platform can also be used to measure the “trend allocation “ risk of portfolios – an important concept based on logic – and spot trend risks early to reduce exposure to falling securities and the risk of underperformance .

Hortz: How does Trendrating compare to other trend following approaches?

Pellegrinelli: Traditional indicators from technical analysis and chart pattern studies often yield inconsistent results across different cycles and market types. They also may generate a long string of conflicting signals during ranging markets and high volatility phases. Old school momentum investing tends can be late as they use fixed time windows that may require time to adjust to fast changing trends. It usually works on a 9-month fixed window with the risk of being late nine months in spotting a trend reversal. Trendrating is the evolution of all this.

The pattern recognition algorithm is faster than old school momentum models in identifying the development of a trend, well before it becomes obvious as a consequence of several months of price moves. At the same time the algorithm is designed to filter out short term moves, volatility, minor price corrections, and therefore limiting erratic signals to keep a clear assessment of the real underlying premier trend and truly important undercurrents developing under the surface of market activity.

Hortz: How do you document the actual alpha contribution of your research platform?

Pellegrinelli: We are different from other research services in providing new market intelligence and technology where we can assert the alpha contribution that can be extracted from our system that is visible, measurable, and trackable in our platform.

We encourage and offer an extended trial period to investment managers to observe and evaluate the edge we offer. They can observe, track, measure, and validate the improved performance that can be obtained in our platform with full transparency.

Investment managers also have the opportunity to track the optimized, multi-parameter strategies we make available in our “insights” and “ directory” sections of our strategy builder and directly discover, in real time, how selecting and combining the right fundamental parameters can fine tune an investment strategy, test it across years, and maximize their returns.

We also document this mission critical investment edge by publishing detailed research reports regularly on our website and with select financial publishers and industry associations. It is extremely gratifying for us to provide professional investors with the enhanced information framework that they need and deserve.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Bill Hortz

Founder Institute for Innovation Development

Bill Hortz is an independent business consultant and Founder/Dean of the Institute for Innovation Development- a financial services business innovation platform and network. With over 30 years of experience in the financial services industry including expertise in sales/marketing/branding of asset management firms, as well as, creatively restructuring and developing internal/external sales and strategic account departments for 5 major financial firms, including OppenheimerFunds, Neuberger&Berman and Templeton Funds Distributors. His wide ranging experiences have led Bill to a strong belief, passion and advocation for strategic thinking, innovation creation and strategic account management as the nexus of business skills needed to address a business environment challenged by an accelerating rate of change.