Student Loan Borrowers Face Looming Credit Score Threat As Repayment Deadline Nears – Financial Freedom Countdown

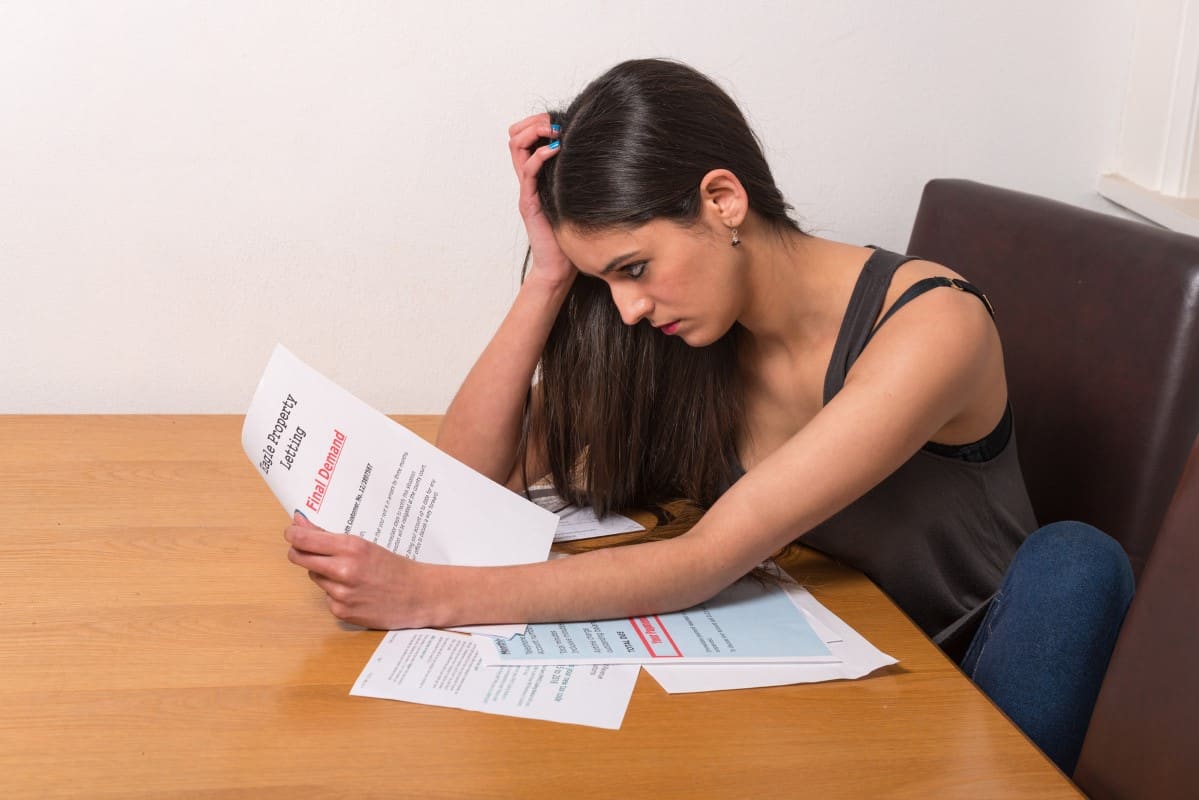

Millions of federal student loan borrowers are at risk of damaging their credit scores as the deadline for repayment approaches. With the expiration of two temporary relief program at the end of September, those who fail to make payments starting in October may see their financial standing suffer. Credit scores, which impact everything from interest rates to insurance premiums, are on the line as the federal government forbearance program that allowed borrowers to delay payments without penalty will sunset.

Student Loan Borrowers Had 4.5 Years of Protections

For over four and a half years, federal student loan borrowers benefited from essential protections that shielded them from the harsh consequences of missed payments and defaults. During the student loan pause, which spanned from March 2020 to September 2023, most borrowers were not required to make payments, and interest was frozen.

When payments resumed last fall, the Education Department introduced the “on-ramp” program, extending some of these safeguards.

Although payments were due, the program provided borrowers with flexibility if payments were missed.

Time’s Running Out: Credit Score Damage Looms for Student Loan Borrowers

The 12-month “on-ramp” period, introduced by President Biden to protect financially vulnerable student loan borrowers, is about to end on September 30. The program allowed those who missed payments to avoid being reported as delinquent, protecting them from credit score damage and other financial consequences.

Public Service Loan Forgiveness (PSLF) borrowers had a little-known fallback option through the on-ramp initiative, which retroactively converted missed payments into forbearance, preventing them from being counted against the borrower. However, this forbearance period could not be credited toward loan forgiveness under PSLF.

To address this, borrowers could potentially use a program called PSLF Buyback, which allows them to make a lump sum payment to “buy back” the time spent in non-qualifying forbearance, enabling those missed payments to eventually count toward student loan forgiveness.

Borrowers Will Face Loan Late Fees as On-Ramp Ends

During the on-ramp period, borrowers were shielded from significant penalties like late fees for missed payments. However, that protection is ending. Starting in October, borrowers who miss payments or pay significantly late will once again incur late fees.

Missing multiple payments can result in accumulating late fees, driving up the overall cost of catching up and avoiding default.

10 Million Borrowers at Risk

According to a recent Government Accountability Office report, around 10 million student loan borrowers were behind on their payments as of January 2023.

Of these, 6.7 million were already at least 90 days past due.

These borrowers have been shielded from negative credit reporting thanks to the on-ramp program, but starting this October, those protections will expire. Without timely payments, the effects on their credit could be severe, lasting for up to seven years.

The Clock is Ticking: Credit Scores at Risk After 90 Days of Missed Payments

Once October hits, borrowers will have 90 days to make payments before their delinquency is reported to credit bureaus.

This means that, by January 2024, many Americans could see their credit scores take a significant hit if they haven’t started repaying their loans.

How to Avoid a Credit Score Hit: What Borrowers Should Do Now

Borrowers can prevent damage to their credit scores by resuming their student loan payments in October. However, many will face larger loan balances due to accumulated interest since the forbearance began.

Financial advisors recommend creating a repayment strategy now to avoid falling behind. For those who can’t afford their monthly payments, options like income-driven repayment plans or working with a financial advisor could help.

No Money to Pay? Ignoring Student Loans Isn’t an Option

Failing to make student loan payments can lead to more than just a hit on your credit. In extreme cases, the government can withhold federal and state tax refunds or garnish wages to collect overdue payments.

Borrowers are encouraged to seek help, whether through a financial advisor or a nonprofit organization, to find the best repayment plan for their situation.

New Repayment Plans on Hold Amid Legal Challenges

For some borrowers, Biden’s new income-driven repayment (IDR) programs—meant to provide lower monthly payments—are currently on hold due to legal challenges. The highly anticipated Saving on a Valuable Education (SAVE) plan, which promised significant relief, has been blocked by federal courts. This means that borrowers hoping for more affordable payment options may need to wait even longer for a resolution.

Beyond Credit Scores: Other Consequences of Not Paying Student Loan

Missing student loan payments doesn’t just hurt your credit. If your loans go into default, the entire loan balance becomes due immediately, and the government has the power to withhold your tax refunds or federal payments to recover the debt.

In some cases, the government could also garnish wages. These harsh penalties can make an already tough financial situation even worse.

Will There Be Another Extension? Don’t Count on It

Despite the multiple extensions of the student loan moratorium since 2020, borrowers should not expect another one. With legal battles and political opposition surrounding debt relief, it’s unlikely that the pause will be extended further.

Preparing for the October Payment Restart: What You Need to Do

With student loan payments resuming soon, it’s crucial for borrowers to take action now. Signing into your loan account, updating your contact information, and exploring different repayment options are key steps to ensure you’re prepared. Borrowers should also consider enrolling in auto-debit to avoid missing payments. With the repayment pause ending, it’s time to get organized and make a plan to minimize financial strain and credit damage.

As the countdown to October begins, millions of Americans face a critical financial decision. Ignoring student loan payments is not an option—doing so risks long-term financial damage, including credit score hits and severe penalties from the government. Now is the time for borrowers to act, plan, and protect their financial futures.

Like Financial Freedom Countdown content? Be sure to follow us!

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

Top 10 Global Hotspots with the Fastest-Growing Millionaire Populations Revealed, Only 3 U.S. Cities Make the Cut

Henley and Partners have identified and ranked the global cities with the highest concentration and fastest growth of millionaires, centi-millionaires, and billionaires for 2023. Below is a list of the top 10 cities.

The 10 States Taxing Social Security in 2024 and the 2 That Just Stopped

As 2023 tax filing season draws to a close, retirees across the nation are adjusting their financial plans for 2024, but a crucial detail could drastically alter the landscape of retirement living: the taxing of Social Security benefits. While many bask in the belief that their golden years will be tax-friendly, residents in specific states are facing a reality check as their Social Security benefits come under the taxman’s purview. Conversely, a wave of relief is set to wash over two states, marking an end to their era of taxing these benefits. This shift paints a complex portrait of retirement planning across the U.S., underscoring the importance of staying informed of the ever changing tax laws. Are you residing in one of these states? It’s time to uncover the impact of these tax changes on your retirement strategy and possibly reconsider your locale choice for those serene post-work years. Here are the 10 states taxing social security benefits.

The States Taxing Social Security in 2024 and the 2 That Just Stopped

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.